Introduction

This report provides an in-depth look at homeowners’ attitudes, motivations, and challenges surrounding home improvement projects as we approach 2025. The findings are based on survey responses from 2,500 homeowners, with an equal representation from four generations: Gen Z, Millennials, Gen X, and Baby Boomers.

By exploring key areas such as project priorities, financial planning, contractor and company selection, and emotional drivers, this report highlights both commonalities and generational differences when it comes to home improvement.

The goal is to offer actionable insights for homeowners, contractors, companies, and industry professionals to better understand the evolving home improvement landscape.

Summary of Key Findings

- All homeowners agree that their biggest fear regarding home improvement projects is poor quality of work. Baby Boomers are worried less about budget overruns than the other three generations, but all four groups ranked poor quality of work, budget overruns and hiring the wrong company/contractor in the top three.

- Millennials and Gen Zers (72%) are most concerned about home improvement costs rising in the future, while Gen Xers (68%) and Baby Boomers (63%) are less concerned than younger generations.

- All four generations agree that finding qualified and trustworthy companies/contractors is the biggest obstacle to getting started on a home improvement project.

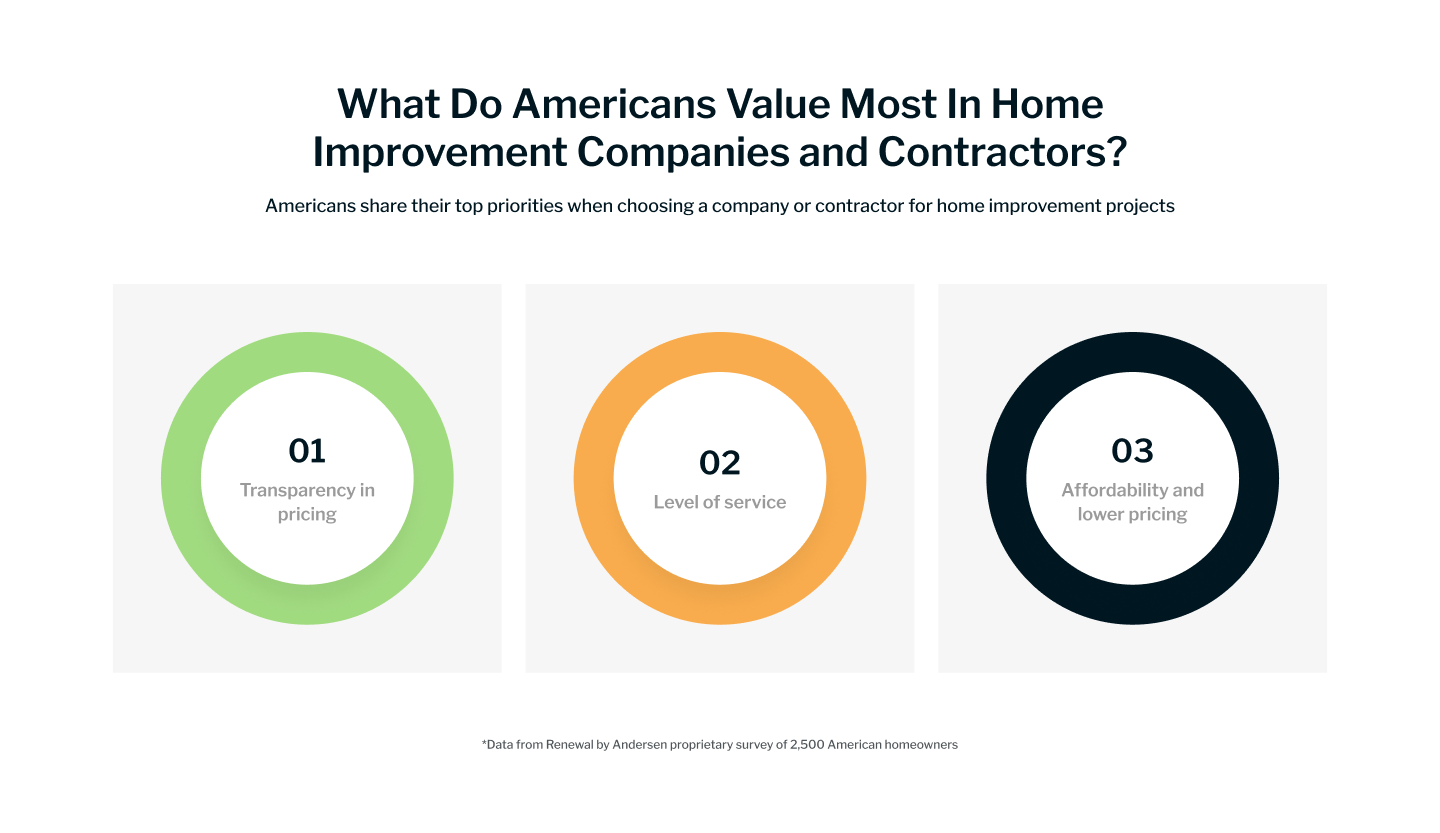

- What’s most important when choosing a company/contractor? All generations agreed that “transparency in pricing” is the most important factor and “level of service” ranked second among all generations.

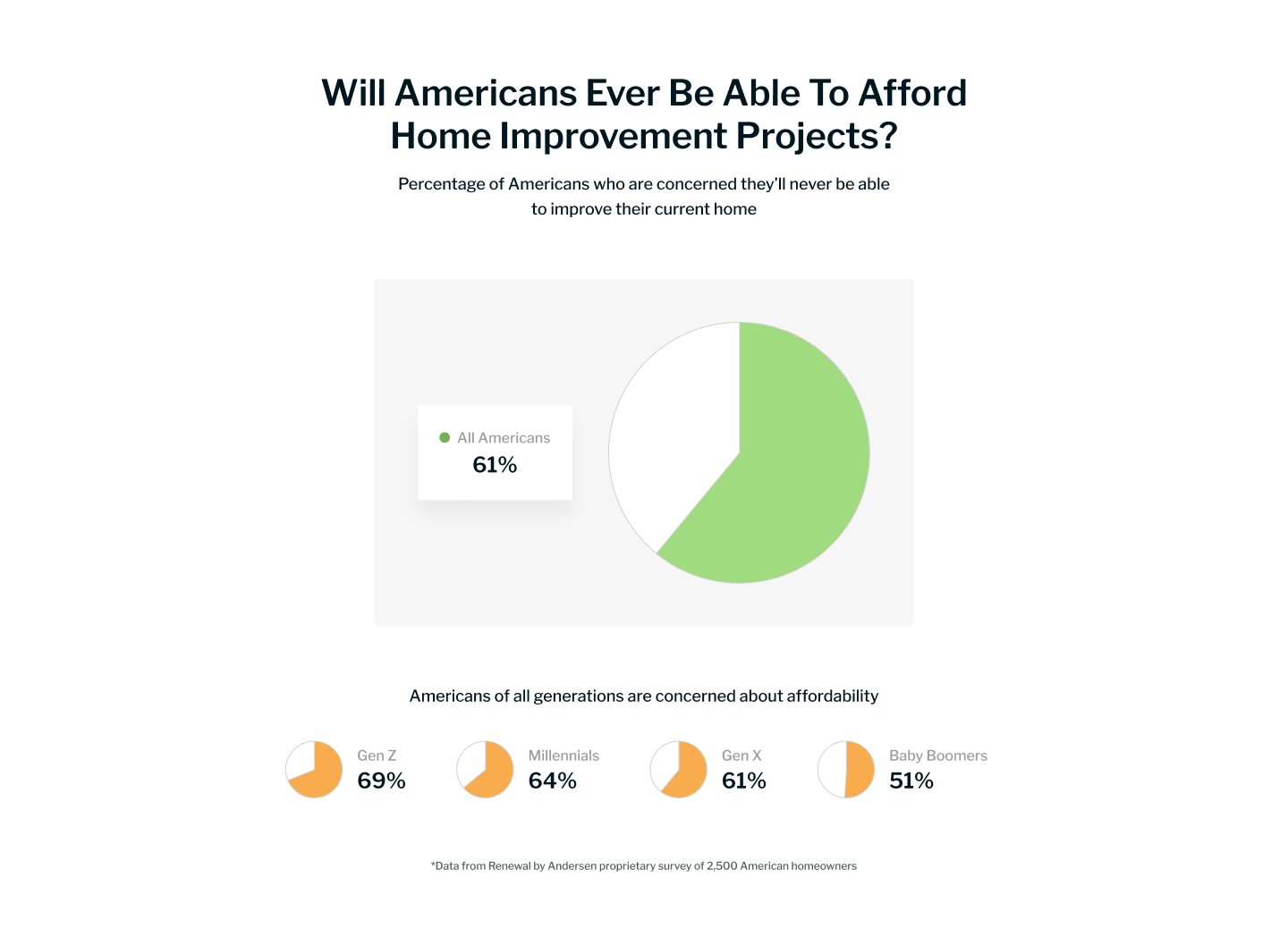

- When asked about concerns of never being able to afford a home improvement project, Gen Z (69%) and Millennials (64%) showed the highest level of concern. Gen Xers (61%) and Baby Boomers (51%) showed much less concern with regard to affordability.

- When asked if affordability was the clear-cut, #1 obstacle to starting a home improvement project, Millennials (68%) and Gen Z (65%) agreed, while Gen Xers (60%) and Baby Boomers (51%) agreed but to a lesser extent.

- 51% of all homeowners said they plan to pay with cash from savings for their next home improvement project. Baby Boomers (60%) lead the way in the cash from savings payment method, while Gen Zers are most likely to get a second job or use a credit card to pay for their projects. Gen Xers are most likely to take out a HELOC, and Millennials lead the way in planning to pay with personal loans.

- 76% of all homeowners say they cannot afford to pay more than $1,000 per month on home improvement projects. More than 50% of all generations say that $500 is their max affordable monthly payment.

- 94% of all homeowners say they are not completely confident that their next home improvement project will stay with the planned budget.

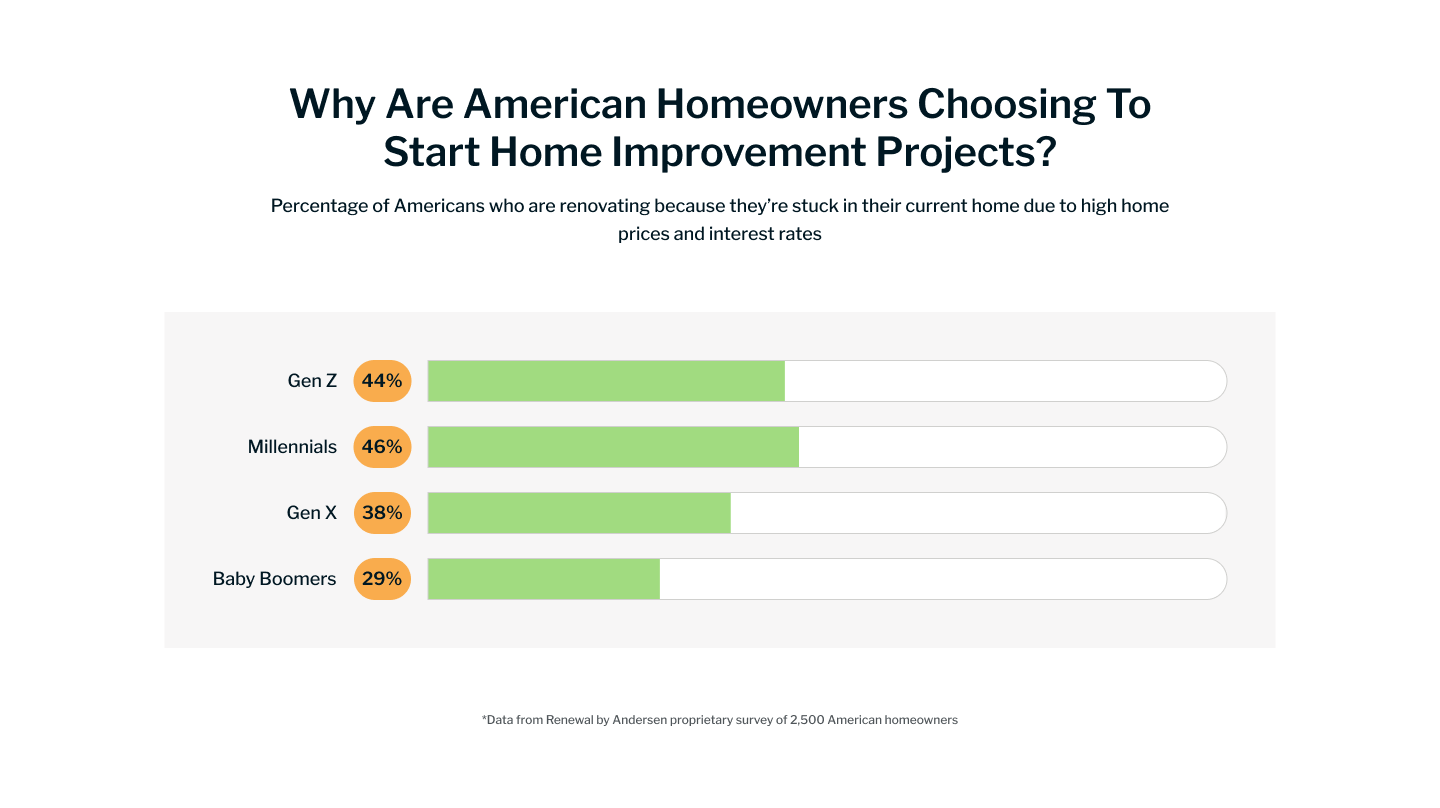

- 46% of Millennials and 44% of Gen Zers say they are planning home improvement projects because they feel stuck in their current home due to home prices and interest rates. Only 38% of Gen Xers and 29% of Baby Boomers echoed this statement.

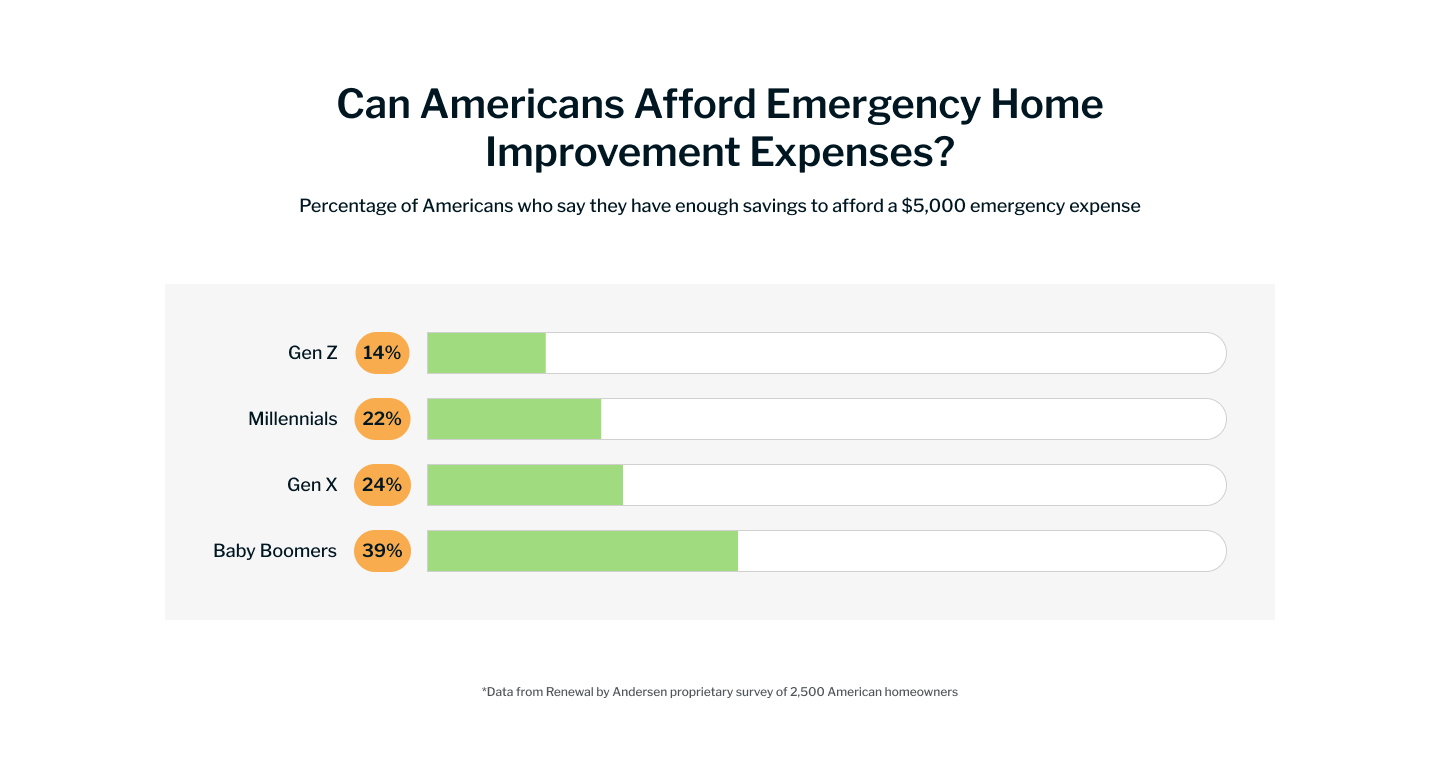

- Only 25% of all homeowners say they have enough money to afford a $5,000 emergency home improvement project/expense. Baby Boomers (39%) are most confident, while Gen Zers (14%) are least confident in being able to afford a $5,000 emergency expense.

Plans for Future Home Improvement Projects

Top Reasons for Starting Home Improvement Projects

Across generations, improving comfort and livability at home emerged as the most cited reason for considering or starting a home improvement project, with modernizing an outdated home closely following as the second most important reason. Interestingly, generational priorities diverged when it came to increasing home value: Gen Z homeowners ranked it as their primary motivator, while Baby Boomers showed less interest in this factor compared to other generations.

Home Improvement Priorities Over the Next 12-24 Months

When asked to rank their top priorities for home improvement projects, homeowners across all generations aligned on the top three: bathroom upgrades, kitchen remodels, and flooring improvements. However, generational differences surfaced in interest areas like window upgrades and replacements. Baby Boomers, Gen Xers, and Millennials placed higher importance on these projects, while Gen Z homeowners showed less enthusiasm.

The Impact of Current Market Conditions

Homeowners’ sentiments on market-driven decisions were strikingly varied. Nearly half of Millennials (46%) and Gen Zers (44%) reported planning home improvement projects because they feel unable to move due to current home prices and interest rates. In contrast, fewer Gen Xers (38%) and Baby Boomers (29%) shared this perspective, reflecting a potential generational gap in how current market challenges are influencing renovation and home improvement motivations.

This data highlights both commonalities and generational differences in homeowners’ motivations and priorities for home improvement projects. Improving comfort and livability at home emerged as a universal priority, with modernizing outdated spaces following closely behind. However, generational perspectives on increasing home value and specific project priorities reveal notable differences—Gen Z places greater emphasis on boosting home value, while Baby Boomers are less motivated by this factor.

Market conditions also play a significant role in shaping renovation motivations, with Millennials and Gen Z feeling more “stuck” in their current homes due to rising prices and interest rates compared to older generations. This generational lens offers valuable insights into how motivations and priorities shift with age and economic factors.

Fears, Obstacles and Emotions Surrounding Home Improvement Projects

Biggest Fears About Home Improvement Projects

Across all generations, the fear of poor-quality work emerged as the most significant concern when undertaking home improvement projects. This anxiety highlights the importance of skilled craftsmanship and trustworthy service providers. While all groups ranked poor quality of work, budget overruns, and hiring the wrong company/contractor as their top three fears, there were generational differences in priorities. Baby Boomers were notably less concerned about budget overruns compared to Gen Zers, Millennials, and Gen Xers, possibly due to having more established financial stability or smaller project scopes.

Biggest Obstacles to Starting Home Improvement Projects

The greatest barrier to beginning a home improvement project, according to homeowners across all generations, is the challenge of finding qualified and trustworthy contractors or companies. This shared obstacle reflects a widespread need for greater transparency, recommendations, and vetting processes within the industry. Secondary obstacles, while varying slightly by age group, include securing the necessary budget and navigating the overwhelming number of choices available.

Concerns About Doing Nothing

When asked about the risks of delaying home improvement projects, rising future costs was the top concern for all generations. This reflects the impact of inflation and potential price increases for materials and labor over time. Decreased comfort at home was consistently ranked second, underscoring the emotional and functional toll of living in a space that no longer meets a homeowner’s needs. These shared concerns suggest that homeowners are motivated not only by practical considerations but also by a desire to improve their daily quality of life.

This data reveals a common thread of fear and hesitation tied to trust and financial management, but also a unifying emotional drive to maintain and enhance the livability of their homes. Understanding these sentiments can help professionals address the pain points of homeowners and build confidence in the renovation process.

Budget Planning for Home Improvement Projects

Monthly Payment Affordability

Budget constraints significantly shape how homeowners approach home improvement projects. A majority (76%) of respondents across generations stated they cannot afford to spend more than $1,000 per month on project payments, with more than half indicating that $500 is their maximum comfortable monthly payment. This highlights a strong need for cost-effective financing solutions and flexible payment plans to make home improvement projects more accessible.

Total Budget Comfort Levels

When asked about their total budget for home improvement projects, 41% of Gen Zers reported that they can afford to spend less than $5,000—the lowest among all generations. In contrast, Millennials (31%), Gen Xers (33%), and Baby Boomers (30%) were more likely to allocate larger budgets, reflecting potentially higher incomes or greater financial stability among these groups.

Confidence in Handling Emergency Expenses

Financial confidence for emergency home improvement costs is notably low across generations. Only 25% of all homeowners feel they have enough savings to cover a $5,000 emergency home improvement expense. Baby Boomers (39%) displayed the highest confidence in their financial preparedness, while Gen Zers (14%) were the least confident. This underscores a generational disparity in financial security, with younger homeowners feeling more financially vulnerable when unexpected repairs arise.

These findings reveal that financial constraints are a major factor influencing homeowners’ renovation and home improvement decisions. The data highlights a widespread need for affordable payment options, better financial planning resources, and support for managing unexpected expenses. For younger homeowners, financial confidence remains a significant hurdle to pursuing larger or emergency improvement projects.

Financing & Affordability of Home Improvement Projects

Concerns About Rising Costs

The fear of rising costs is a significant factor driving urgency for home improvement projects, particularly among younger generations. Millennials and Gen Zers (72%) expressed the highest concern that waiting could make future projects unaffordable, while Gen Xers (68%) and Baby Boomers (63%) were slightly less concerned. This generational divide reflects differing perspectives on financial pressures and future planning.

Affordability Challenges

Younger homeowners are also more apprehensive about their ability to afford home improvement projects. When asked about concerns of never being able to afford a renovation, 69% of Gen Zers and 64% of Millennials expressed worry, compared to 61% of Gen Xers and 51% of Baby Boomers. Similarly, Millennials (68%) and Gen Zers (65%) were more likely to cite affordability as the primary obstacle to starting a project, though Gen Xers (60%) and Baby Boomers (51%) agreed at lower rates. These findings highlight affordability as a critical barrier, especially for younger generations.

Methods of Financing

Homeowners take varied approaches to financing home improvement projects, often influenced by generational financial habits and resources. Over half of all respondents (51%) plan to pay for their next project with cash from savings, with Baby Boomers (60%) leading this approach, emphasizing their preference for debt-free payment methods. In contrast, Gen Zers are the most likely to consider alternative methods like taking a second job or using a credit card, reflecting their limited savings. Gen Xers are most inclined to take out a Home Equity Line of Credit (HELOC), leveraging home equity for financing, while Millennials stand out for favoring personal loans.

This data underscores the strong influence of affordability and financing options on home improvement decisions. Younger generations face more financial constraints and are exploring diverse, often less traditional payment methods. Meanwhile, older homeowners demonstrate greater confidence and reliance on savings. The industry can address these challenges by offering tailored financial solutions, such as flexible payment plans, low-interest financing, or educational resources to help homeowners plan and budget effectively.

Hiring Desires and Concerns for Home Improvement Projects

What Homeowners Value Most When Choosing a Contractor or Company

When selecting a contractor or company for home improvement projects, homeowners across all generations prioritize transparency in pricing above all else. This indicates a widespread need for clear, upfront cost information to foster trust and minimize surprises during the project. The “level of service” ranked as the second most important factor, underscoring the importance of professionalism, communication, and attention to detail in contractor-client relationships.

Confidence in Budget and Timeline Management

A striking 94% of homeowners expressed a lack of complete confidence that their next contractor or company will keep their project within the planned budget and timeline. This overwhelming concern highlights an industry-wide struggle to meet homeowner expectations, contributing to hesitation and anxiety around starting renovation projects.

Key Struggles Across Generations

Homeowners face consistent struggles when it comes to hiring contractors, with transparency and reliability standing out as the most critical pain points. While younger generations may have less experience navigating contractor relationships, their priorities align closely with those of older generations, emphasizing universal desires for clarity, accountability, and trustworthiness.

The data reveals that concerns about budget overruns, timeline delays, and unclear pricing dominate homeowners’ fears when hiring contractors or companies. To alleviate these struggles, contractors and service providers should focus on improving communication, offering detailed estimates, and building trust through transparent business practices. For homeowners, additional resources such as contractor vetting guides and budgeting tools may help build confidence and facilitate smoother project planning.

What’s Next for Home Improvement in 2025 and Beyond?

Overall, the data reveals a complex but unified picture of homeowners’ attitudes, priorities, and concerns about home improvement projects as we approach 2025. Across all generations, improving comfort and livability remains the driving force behind home renovation decisions. However, generational differences in motivations, budgets, and financial confidence highlight a need for tailored approaches to meet the diverse needs of homeowners

Affordability is a significant barrier for most homeowners, with many struggling to budget for monthly payments or large-scale expenses. Younger generations, particularly Gen Zers and Millennials, feel the most financial strain, expressing high levels of concern about the rising costs of waiting and their ability to afford projects in the current economy. Baby Boomers, while more financially confident, still face challenges in balancing costs with desired outcomes. The reliance on cash savings across all groups points to a preference for upfront, manageable payment solutions, but younger homeowners are exploring alternatives such as loans and credit, signaling a potential market for innovative financing options.

A universal lack of confidence in contractors’ ability to stay within budget and timelines reflects broader industry challenges. Transparency in pricing and level of service are top priorities for all generations, emphasizing a need for contractors to adopt more customer-centric practices. Clear communication, realistic estimates, and a commitment to quality are critical for building trust and alleviating homeowner fears.

Generational divides reveal evolving priorities and constraints. Gen Zers and Millennials are driven by concerns about increasing home value and adapting to rising costs, while Baby Boomers focus more on maintaining comfort and functionality. Market conditions, such as high interest rates and housing costs, disproportionately affect younger homeowners, who feel “stuck” in their current homes and turn to renovations as a solution.

Looking Ahead to 2025

As we move into 2025, the home improvement landscape is shaped by economic pressures, changing homeowner priorities, and a growing demand for trustworthy service providers. To address these trends, the industry must focus on:

- Affordability and Financing: Providing flexible payment options, transparent pricing, and innovative financial tools to support diverse budgets.

- Trust and Confidence: Strengthening customer relationships through better communication, reliable timelines, and quality assurances.

- Customization: Adapting services and products to meet the unique needs and motivations of each generation.

These findings underscore that while homeowners are united in their desire to improve their living spaces, their paths to achieving these goals vary significantly. Understanding and addressing these generational nuances will be key to navigating the future of home improvement and renovation projects. As the industry evolves, proactive solutions that prioritize affordability, transparency, and customer satisfaction will set the stage for success.

For more information about this report, please reach out to sradbil@esler.com.

Methodology

All data found within this report is derived from a survey by Renewal by Andersen conducted online via survey platform Pollfish from November 1-7, 2025. In total, 2,500 adult American homeowners (an equal number from each generation) were surveyed. The respondents were found via Pollfish’s age and housing filtering features. This survey was conducted over a seven-day span, and all respondents were asked to answer all questions as truthfully as possible and to the best of their knowledge and abilities.

Schedule a Consultation